Carry Trade: Enhancing Returns By Arbitraging Interest Rate Differentials. The practice of borrowing at a low interest rate in one currency and investing in a higher interest rate currency - or carry trade - is a popular strategy for enhancing returns.

Editor's Note: Carry Trade: Enhancing Returns By Arbitraging Interest Rate Differentials published today provides in-depth analysis on carry trade, the strategy, and its importance.

After extensive research and analysis, we present this guide to help you understand the nuances of carry trade and make informed decisions.

| Carry Trade | Traditional Investment | |

| Borrowing Currency | Low interest rate currency | N/A |

| Investment Currency | High interest rate currency | N/A |

| Return | Interest rate differential | Returns based on market performance |

| Risk | Currency exchange risk | Market risk |

Main Article Topics

FAQ about Carry Trade: Enhancing Returns By Arbitraging Interest Rate Differentials

A carry trade involves borrowing funds in a currency with a low interest rate and investing the proceeds in a higher-yielding currency. The difference between the interest paid on the borrowed funds and the interest earned on the investment constitutes the carry. Carry trades can be used to enhance returns, but they also carry some risks, such as exchange rate fluctuations.

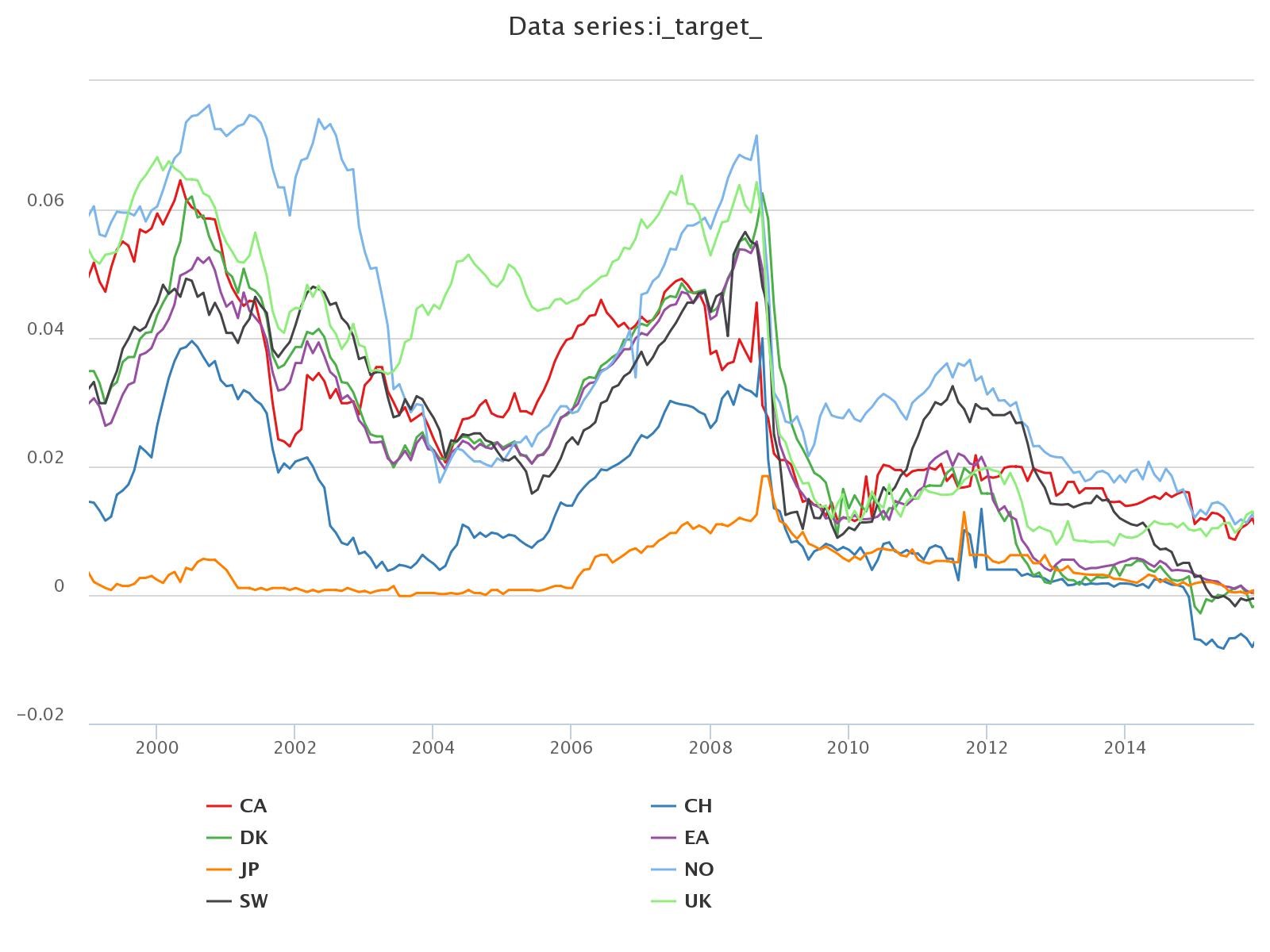

Interest Differentials and Exchange Rate Changes Before and After the - Source econbrowser.com

Question 1: What are the benefits of carry trade?

Carry trades can offer several benefits, including the potential for enhanced returns, diversification of portfolios, and hedging against interest rate fluctuations.

Question 2: What are the risks associated with carry trade?

Carry trades are subject to several risks, including exchange rate fluctuations, interest rate changes, and political and economic instability.

Question 3: How can I mitigate the risks associated with carry trade?

There are several strategies that can be employed to mitigate the risks associated with carry trades, such as diversification, hedging, and careful risk management.

Question 4: Is carry trade suitable for all investors?

Carry trades are not suitable for all investors. They are typically more appropriate for experienced investors who are comfortable with the risks involved.

Question 5: How can I learn more about carry trade?

There are several resources available to help investors learn more about carry trade, including books, articles, and online courses.

Question 6: What are some common misconceptions about carry trade?

There are several common misconceptions about carry trade, such as the belief that it is a risk-free strategy or that it can generate consistent returns.

In summary, carry trades can provide investors with several potential benefits, but they also carry some risks. It is essential to understand the risks involved and take steps to mitigate them before entering into a carry trade.

Tips by Carry Trade: Enhancing Returns By Arbitraging Interest Rate Differentials

The carry trade involves borrowing a currency with a lower interest rate and investing it in a currency with a higher interest rate, aiming to profit from the interest rate differential. Here are some tips to enhance returns while engaging in carry trade:

Enhanced FX Carry Strategy | Millennium Global Investments - Source investments.millenniumglobal.com

Tip 1: Monitor Interest Rate Differentials

Thoroughly analyze interest rate differentials between different currencies. The larger the differential, the greater the potential return on the carry trade. However, keep in mind that higher differentials often indicate higher risks as well.

Tip 2: Risk Assessment and Management

Identify and assess the risks associated with the carry trade, including currency fluctuations, liquidity risks, and changes in interest rate policies. Utilize hedging strategies such as forward contracts or currency options to mitigate these risks.

Tip 3: Diversify Across Countries and Currencies

Spread investments across multiple countries and currencies to reduce exposure to a single currency's risk. Diversification helps balance the risk-reward profile of the carry trade portfolio.

Tip 4: Consider Economic and Political Factors

Apart from interest rates, consider economic and political factors that may influence currency exchange rates. Favorable economic conditions, a stable political climate, and positive market sentiment contribute to higher demand for a currency, enhancing carry trade returns.

Tip 5: Exit Strategy and Monitoring

Establish a clear exit strategy to determine when to unwind the carry trade position. Continuously monitor the interest rate differentials, currency fluctuations, and overall market conditions to make timely adjustments and secure profits.

By incorporating these tips, investors can potentially enhance returns while managing the risks associated with carry trade.

Carry Trade: Enhancing Returns By Arbitraging Interest Rate Differentials

A carry trade involves borrowing in a currency with a low-interest rate and investing in another currency with a higher interest rate. This strategy exploits the interest rate differential between the two currencies to generate a positive return.

Different Ways To Trade Forex - Source unbrick.id

- Interest Rate Differentials: The foundation of a carry trade is the difference in interest rates between two currencies.

- Borrowing Costs: The interest paid on the borrowed currency must be lower than the interest earned on the invested currency.

- Currency Exchange Rates: Fluctuations in exchange rates can impact the profitability of a carry trade.

- Risk Management: Careful risk management is crucial to mitigate potential losses from currency devaluation or interest rate changes.

- Carry Trade Example: Borrowing Japanese Yen at near-zero interest rates and investing in New Zealand Dollars with higher interest rates.

- Economic Impact: Carry trades can influence currency values and capital flows, potentially affecting national economies.

Carry trades offer the potential to enhance returns, but they also carry risks. The key aspects discussed above provide a framework for understanding the opportunities and challenges involved in this sophisticated trading strategy.

Yen carry trade at a crossroads: How interest rate hikes in Japan are - Source www.archyde.com

Carry Trade: Enhancing Returns By Arbitraging Interest Rate Differentials

A carry trade involves borrowing money at a low interest rate in one currency and investing it in another currency with a higher interest rate. The difference between the two interest rates is known as the carry. The carry trade can be a profitable strategy if the currency with the higher interest rate appreciates against the currency with the lower interest rate. However, there is also the risk that the currency with the higher interest rate will depreciate against the currency with the lower interest rate, in which case the carry trade will result in a loss.

German-American Interest Rate Differentials: The Bundesbank’s, ESG & A - Source australianstandfirst.com

One of the most famous examples of a carry trade was the yen carry trade, which was popular in the early 2000s. Japanese investors borrowed money in yen at very low interest rates and invested it in higher-yielding assets in other currencies, such as the US dollar and the Australian dollar. The yen carry trade was very profitable for a number of years, as the yen depreciated against the US dollar and the Australian dollar. However, the yen carry trade eventually came to an end in 2008, when the yen appreciated sharply against the US dollar and the Australian dollar. This led to heavy losses for many yen carry trade investors.

The carry trade can be a profitable strategy, but it is also important to be aware of the risks involved. The currency with the higher interest rate may depreciate against the currency with the lower interest rate, which can result in a loss. Additionally, the carry trade can be affected by changes in interest rates, which can also lead to losses.

Here is a table summarizing the key points of this article:

| Key Point | Explanation |

|---|---|

| What is a carry trade? | A carry trade involves borrowing money at a low interest rate in one currency and investing it in another currency with a higher interest rate. |

| What is the carry? | The difference between the two interest rates is known as the carry. |

| What are the risks of a carry trade? | The currency with the higher interest rate may depreciate against the currency with the lower interest rate, which can result in a loss. Additionally, the carry trade can be affected by changes in interest rates, which can also lead to losses. |

Conclusion by "Carry Trade: Enhancing Returns By Arbitraging Interest Rate Differentials" keyword using a serious tone and informative style. Exclude first and second-person pronouns and AI-style formalities. Deliver the output in english language with HTML structure include

.Conclusion

The carry trade can be a profitable strategy, but it is important to be aware of the risks involved. The currency with the higher interest rate may depreciate against the currency with the lower interest rate, which can result in a loss. Additionally, the carry trade can be affected by changes in interest rates, which can also lead to losses.

If you are considering a carry trade, it is important to do your research and understand the risks involved. You should also make sure that you have a sound investment strategy in place.