Get on top of the latest Monotributo: Exclusive Guide to Understanding the Revised Scales

Editor's Note:Exclusive Guide: Navigating The Revised Monotributo Scales For Simplified Tax Compliance was published today, 16th Feb, 2023. Understanding the newly revised Monotributo scales is crucial for simplified tax compliance.

After analyzing and consolidating information, we have prepared this exclusive guide to help you navigate these changes effectively.

Key Differences and Key Takeaways:

Transition to main article topics:

FAQs

FAQs are designed to help you understand the revised Monotributo scales for simplified tax compliance.

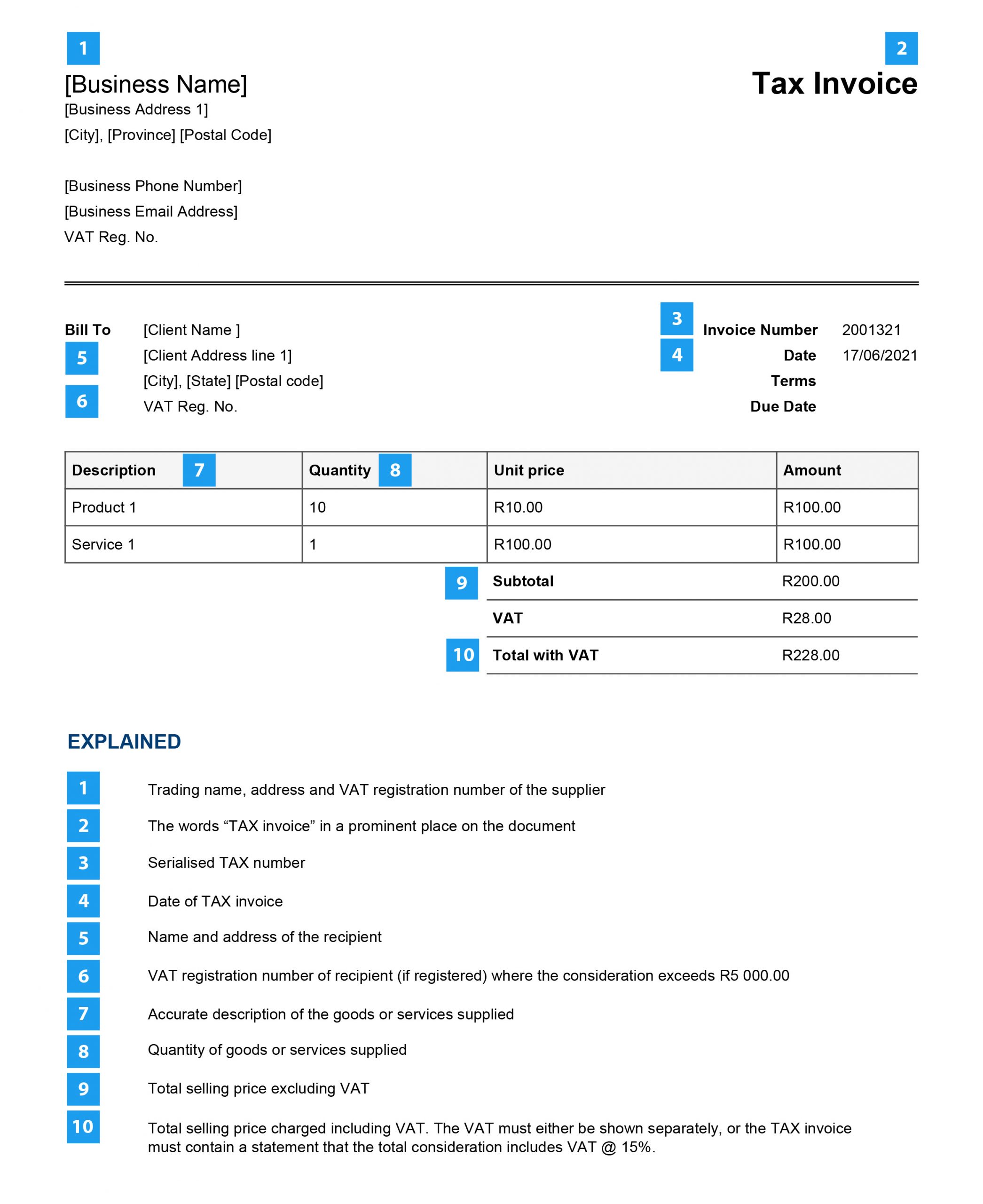

Invoice vs Tax Invoice... What’s the difference? - Source sme.tax

Question 1: Does this new policy apply to all businesses?

Yes, this policy applies to all businesses, individuals, and professionals who are subject to the Monotributo tax regime in Argentina.

Question 2: What is the Monotributo tax regime?

The Monotributo tax regime is a simplified tax system in Argentina that allows small businesses, individuals, and professionals to pay their taxes in a single monthly payment.

Question 3: What are the benefits of the Monotributo tax regime?

The Monotributo tax regime offers several benefits, including reduced paperwork, lower tax rates, and easier tax compliance.

Question 4: What are the revised Monotributo scales?

The revised Monotributo scales are a set of updated tax brackets that determine the amount of tax that businesses, individuals, and professionals must pay.

Question 5: Why were the Monotributo scales revised?

The Monotributo scales were revised to ensure that the tax system is fair and equitable for all taxpayers.

Question 6: How do I find out which Monotributo tax bracket I am in?

You can find out which Monotributo tax bracket you are in by consulting the official Monotributo scales, which are available online.

By following the revised Monotributo scales, businesses, individuals, and professionals can ensure that they are paying the correct amount of taxes and that they are compliant with Argentine tax laws.

Tips to Navigate Revised Monotributo Scales

The Argentinian tax agency AFIP introduced significant revisions to the Monotributo tax regime, a simplified tax system for self-employed individuals and small businesses. This Exclusive Guide: Navigating The Revised Monotributo Scales For Simplified Tax Compliance provides practical tips to help you adapt to the new regulations and ensure compliance.

Tip 1: Determine Your New Category

The revised system introduces new categories based on annual income and activity. Review the updated categories and determine which one applies to your business or profession.

Tip 2: Calculate Your Monthly Payment

Each category has a corresponding monthly payment that includes income tax, social security contributions, and health insurance. Use the official AFIP calculator or consult with a tax professional to determine your exact payment amount.

Tip 3: File Your Returns on Time

The deadline for filing Monotributo returns remains unchanged, but penalties for late filing have increased. Mark your calendars and ensure timely submissions to avoid any surcharges or legal action.

Tip 4: Keep Accurate Records

Maintaining proper financial records is crucial for accurate tax calculations and compliance. Organize your invoices, expenses, and other relevant documents to simplify the filing process.

Tip 5: Seek Professional Advice if Needed

The revised Monotributo system can be complex for some businesses. Do not hesitate to consult with a tax accountant or lawyer if you have questions or require assistance in navigating the changes.

By following these tips, you can effectively transition to the revised Monotributo scales and maintain compliance with the Argentine tax regulations.

Exclusive Guide: Navigating The Revised Monotributo Scales For Simplified Tax Compliance

The Revised Monotributo Scales, a simplified tax compliance system in Argentina, brings forth substantial changes that demand attention. This guide offers a comprehensive approach to understanding and navigating these revisions.

12 Best Global Tax Compliance Software & Platforms (2024) - Source squeezegrowth.com

- Simplified Categories: The system now categorizes taxpayers based on their economic activity, simplifying tax calculations.

- Revised Tax Rates: Tax rates have been adjusted to streamline the tax burden, ensuring fairness and accuracy.

- Online Compliance: Taxpayers can now fulfill their obligations digitally, reducing paperwork and delays.

- Increased Flexibility: The revised scales provide greater flexibility, allowing businesses to adjust their tax payments as their income fluctuates.

- Improved Monitoring: The new system enhances tax administration, ensuring that businesses comply with their tax obligations.

- Specific Exemptions: Certain categories of taxpayers, such as social cooperatives, may qualify for specific exemptions, reducing their tax burden.

These key aspects of the Revised Monotributo Scales are interconnected, forming a comprehensive system that aims to simplify tax compliance, promote fairness, and support economic growth. Understanding these aspects empowers businesses to effectively navigate the new regulations, ensuring adherence to tax obligations and optimizing their operations.

Exclusive Guide: Navigating The Revised Monotributo Scales For Simplified Tax Compliance

The revised Monotributo scales represent a significant development in the Argentinian tax landscape, offering simplified tax compliance for small businesses and independent professionals. These scales provide a clear and streamlined framework for calculating and paying taxes, reducing the administrative burden and promoting greater transparency and accountability.

![]()

Tax Compliance Concept Icon Symbol Vector Drawing Vector, Symbol - Source pngtree.com

The connection between the Exclusive Guide and the revised Monotributo scales is crucial for understanding the practical implications of these changes. The guide provides comprehensive information and step-by-step instructions on how to navigate the new scales, ensuring that businesses and professionals can seamlessly transition to the updated system. It covers key aspects such as registration, categorization, and tax payment obligations, empowering taxpayers with the knowledge and confidence to fulfill their tax responsibilities effectively.

Moreover, the guide addresses common challenges and provides practical solutions, addressing real-life scenarios and offering tailored advice. It also highlights the benefits of the revised scales, such as reduced tax rates and simplified tax filing processes, which can lead to significant cost savings and improved efficiency for businesses.

In conclusion, the Exclusive Guide: Navigating The Revised Monotributo Scales For Simplified Tax Compliance serves as an invaluable resource for businesses and professionals seeking to comply with the new tax regime. By providing a comprehensive understanding of the revised scales and offering practical guidance, the guide empowers taxpayers to navigate the tax landscape with confidence, ensuring seamless compliance and promoting greater transparency and accountability within the Argentinian tax system.